Can you recall the last time you made a significant purchase, say a laptop? You might have asked known people with good technical knowledge for recommendations or skimmed through blogs and review videos to get a better understanding of the good models in the market. Your search history might likely be filled with several links on laptop model research and questions along the lines of what laptop is good for people in my profession.

Imagine if you had all this information in one place. A piece of content focusing on a specific problem and what solution worked best for it. Welcome to the world of case studies!

Now, let’s narrow it down to the fintech industry.

Consider this: You are heading towards a meeting with a potential client who has shown interest in your services but is not convinced yet. As Jens Woloszczk, Managing Director/COO at Vontobel, mentions, “One of the biggest challenges you face as a fintech is gaining the trust of your customers. After all, fintechs deal with people’s livelihoods: their cash, credit, savings and assets.”

Thus, you must be prepared with material to establish trust and credibility with the client. One way to do this is by showcasing your success stories. During this, you’re also sharing your working style, which can serve as a bonus aspect the client might appreciate while considering their decision.

Moreover, in several meetings, you can use these case studies as references to convey the following:

- Quality of your fintech solutions

- Accomplishments

- Problem-solving potential

Table of Contents

ToggleA Tool for Marketing

When you try to build trust with your clients and hope to attract more using your success stories, you’re ultimately using case studies as a part of your fintech marketing strategies. A major reason to use this tool is the power of real-world evidence that customer experience case studies leverage.

First, what is a case study? It is basically an in-depth portrayal of a company’s journey in problem-solving. It discusses a particular problem the company faced, its challenges, the solution, and most importantly, its impact. Each of these aspects and their relevance has been elaborated further in the blog. More than attracting customers, a well-timed case study can be the final nudge they need to commit to your solution.

A report that compiles all that is required – customer experience, statistics, testimonials, etc.- to establish a connection with the client is a key component in customer acquisition.

The Power of Case Studies

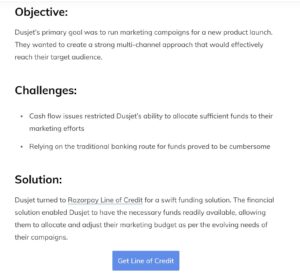

Alongside videos, blogs, and similar formats, case studies are another important weapon in your arsenal while content marketing for financial services. They provide concrete examples of how your solutions have solved real problems for real clients. Take this Razorpay case study, for instance. It shows how Razorpay, a leading provider of digital tools for rural and suburban businesses, used its product, Razorpay Line of Credit, to drive the success of Dusjet’s new launch.

Such high-quality case studies gather an audience. When someone searches for fintech solutions, they will likely click on a case study that promises insights and solutions. These case studies not only bring traffic to your website but also keep visitors engaged, as they are interested in real success stories.

According to the State of Inbound Marketing Trends 2022 report by HubSpot, about 42% of marketers use case studies to increase brand awareness and boost credibility.

Impact of Testimonials:

While case studies describe the problems, challenges, and solutions provided by your B2B fintech company, testimonials act as a seal of approval or recommendation. If placed strategically on your website, they can be powerful, persuasive elements.

When a satisfied client shares their positive experience, whether about your ideas, team expertise, work ethic, or dedication, other potential clients take notice; consequently, when a potential client reads about others who’ve benefited from your fintech solutions, it instills confidence.

Role in Closing Sales

While marketing for fintech, you might notice how clients often seek assurance that the solutions they invest in will deliver the promised results. They may also have doubts about this.

Here, your fintech case study can cure their conflicts and demonstrate the value of your solution in practical terms. The question is how. Let’s understand it better by using the Razorpay case study mentioned above, You can see how Razorpay mentions the challenges faced by the client and the way the former addressed them. Along with this, they also added the link to get more information on their product turned solution – Line of Credit.

Thus, a case study is all the information you need to attract and gain a customer in one place.

It is crucial to note that this way of fintech marketing is not limited to established or experienced companies. Even as a beginner, case studies can be a tool for jumpstarting your business. Think about it as a chain reaction. As soon as you finish your first project, you can create a case study about it and start sharing it. Following that, you might get three other potential clients, and eventually, the chain will fall into a growing pattern.

Case Studies Can Help You Get Noticed by AI

Case studies also serve a bigger purpose today–they can amplify your brand’s visibility in places you might not even realize.

We’re talking about Generative Engine Optimization (GEO) or AI Optimization (AIO).

People are turning to LLM powered tools like ChatGPT, Gemini, or Copilot to answer questions, make decisions, or even shortlist service providers. Thus, the content these tools pull from becomes a key discovery channel.

Well-crafted case studies with data, outcomes, and the right structure are more likely to be cited, summarized, or referenced by these models.

- If your case study is being referenced by generative models in responses, you’re organically reaching users who never even landed on your site via Google.

- Problem–solution–result formats make it easy for AI to digest and repurpose your content.

- Numbers and measurable outcomes are AI candy (and we love them too).

Thus, optimizing the case studies for generative engines will improve the readability and make them more discoverable. And discoverability is where traction begins.

Challenges While Preparing Case Studies

Although this marketing tool has several advantages, it also has a few challenges. Don’t worry, though- they are curable.

- Privacy and Confidentiality: Fintech often deals with sensitive financial data. Maintaining client confidentiality while showcasing success can be challenging, but you can replace sensitive information with pseudonyms or general descriptions.

- Complexity of Fintech Solutions: While fintech solutions can be intricate and difficult to explain, you can use “layman’s terms” that your target audience can understand.

- Diversity of Client Needs: Fintech clients have diverse needs and challenges. Although a single case study may only resonate with some potential clients, try tailoring them to specific industries or client personas.

Approach to Writing a Case Study

After an overview of what a case study is, we can discuss the foundation for preparing one. It is essential to be clear about these aspects before getting started.

- Why:

The purpose of a fintech case study is critical. You need to define why you are writing it. Is it to showcase the success of your product or service? Or to demonstrate how your solution solved a particular problem for a client or customer? Understanding the “why” helps you set clear objectives for your case study.

- What:

Outline what aspects you wish to include in the case study and the nature of the data. This includes deciding on the structure of the case study. Common elements in a fintech case study may include an introduction, problem statement, solution, results, and conclusion. The nature of data should involve both qualitative and quantitative information, such as customer testimonials, data on improved efficiency, or revenue growth.

- How:

Once you’ve decided on the structure and data, you must explain how you will fill in the gaps or provide details. This involves the process of collecting data, conducting interviews, and choosing the most relevant and compelling information to include. The “how” also involves the tone and style of writing, which should be clear, concise, and engaging.

Understanding the Target Audience

As one of the B2B fintech companies in the industry, understanding your target audience is key. To ensure your fintech marketing strategies hit the right nerve, identify their pain points, challenges, and needs. Learning about their issues streamlines your case study toward addressing these pain points directly.

Also, figure out what success looks like for your target audience. It can involve achieving specific goals, overcoming challenges, or realizing certain benefits. Your case study should clearly show how your solution helped your client achieve this success.

Power of Storytelling

Crafting a Compelling Narrative: A great advantage of storytelling is creating a clear narrative structure that hooks the reader’s attention. It then guides them through the journey and various elements of the case study, providing a satisfying reading experience.

Take this case study by Fintech OS, for instance. Starting with a brief introduction, followed by context, problem, and solution, before ending with a long-term perspective and testimonials, the case study displays a well-explained narrative.

Building a Connection with the Audience: Effective storytelling in a customer experience case study involves connecting with the audience. As you share the client’s background, situation, and how you helped them through it, do it in a way where readers can relate. Making the story feel personal and relatable leads to a higher chance of ingraining it in the reader’s mind.

Showcasing Transformation: Another important aspect of fintech case studies is showcasing transformation. Here, you can illustrate the “before-during-after” of the journey.

- Before: State of the client’s problem, highlighting the pain points and challenges they were experiencing.

- During: Go into the detailing of how your fintech solution was implemented; for instance, you can discuss specific decisions and strategies applied.

- After: This is what potential clients especially focus on – the outcome. It shows how well you turned a problem around, leaving a positive impact.

Social Proof and Credibility: Storytelling can also enhance social proof and credibility by including quotes and testimonials from the client, highlighting their satisfaction. Testimonials add authenticity to the story.

Preparing a Case Study

Key components and structure:

- Headline: Create a compelling and concise headline that grabs the reader’s attention and conveys the main subject or achievement of the case study.

- Summary: Unlike usual storytelling techniques, where you hold the outcome for the end, case studies need to start with a summary that provides a snapshot of the case study’s key highlights.

- Context: Looking at a case study by Eastnets, you can notice how the ‘background’ gives relevant information about their client’s goal and how Eastnets’s solution could help.

- Challenge: Clearly define the problem or challenge the client faced. Use real numbers or anecdotes to make it relatable. Explain the pain points in detail. From there, you can start transitioning into how your fintech agency tackled these specific challenges.

- Solution: This is the part where you can describe your fintech solution and how it was implemented. Intertwining the features of your solution with engaging visuals and descriptive storytelling makes the reader feel like they are part of the story.

- Results: This is a critical section that demonstrates the value of your fintech solution. Highlight the outcomes and impact of your solution by using metrics and real data to quantify the success. These metrics can be in the form of increased revenue, ROI, or error reduction.

You can also showcase before-and-after comparisons. It helps readers visualize the transformation and understand the magnitude of the improvements.

- Support: Like a cherry on top, include testimonials or quotes from the client, showcasing their satisfaction with your fintech solution. This adds credibility and further engages the reader.

Final Impact

- Increased credibility of your fintech solution

- Boost of client’s confidence while choosing your agency

- Sharing of experience and your style of work

Role of Content Marketing Agencies

As founders or leaders of B2B fintech companies, many aspects require your attention. Delegating tasks for certain goals might save time and costs, for instance, writing and designing case studies.

With expert field knowledge and marketing experience, fintech content marketing agencies can be the solution you’re looking for. They can help you showcase your most effective solutions and extensive problem-solving skills in the best possible way.

Here is an example of how The Wise Idiot has assisted other agencies in the fintech industry in growing their reach.

Final Thoughts

Like how taste is the best marketer of a food brand, case studies are the best marketers of fintech solutions! As you efficiently start solving problems for other businesses and display their satisfaction through customer experience case study and testimonials, a chain starts. The success of one attracts other potential success stories.

Like a well-decorated cake that leaves a delicious taste on the tongue, a well-written and aptly designed case study brings more traffic and conversion rates. Our team at The Wise Idiot is ready to make good things better for you. You can visit our website for more details and schedule a call today!

Frequently Asked Questions

Q1. What information should be included in a case study?

Ans. Basic information included in a case study should be the context, problem statement, challenges, solution, and result.

Q2. What are some tips to write a good case study?

Ans. Covering it briefly, here are some essential components that make up a good case study:

- Start with the key takeaways to hook the readers

- Use storytelling to create a compelling narrative

- Adding engaging visuals to break complex terms and problems

- Use layperson’s terms or explain field-specific jargon, allowing the audience to keep up

- Add testimonials and customer experience to establish credibility and authenticity

Q3. How do you promote your B2B fintech businesses using case studies?

Ans. You can share them with potential clients in meetings or make them readily available for high-intent customers. Ensure uploading optimized, well-designed case studies on your website to gain an organic audience, too.

Q4. Where can I find good marketing case studies?

Ans. Some companies that showcase good fintech case studies are:

Razorpay, Fintech OS, Eastnets, The Wise Idiot.