There is a famous story about King Midas in Greek mythology. He was granted the ability to turn everything he touched into gold, which seemed thrilling at first. Soon, he realised that he couldn’t eat, drink or even touch his loved ones without turning them into gold. He became isolated and unhappy and eventually begged the Gods to take back his gift. The King found that his power has no use.

Similarly, a fintech brand that focuses solely on creating content may end up with a lot of content but no engagement, no leads and no conversions. To avoid these pitfalls for your fintech brand, you need to have a well-planned content marketing strategy. Here is a detailed step-by-step guide for creating a content marketing plan for your fintech organisation.

Table of Contents

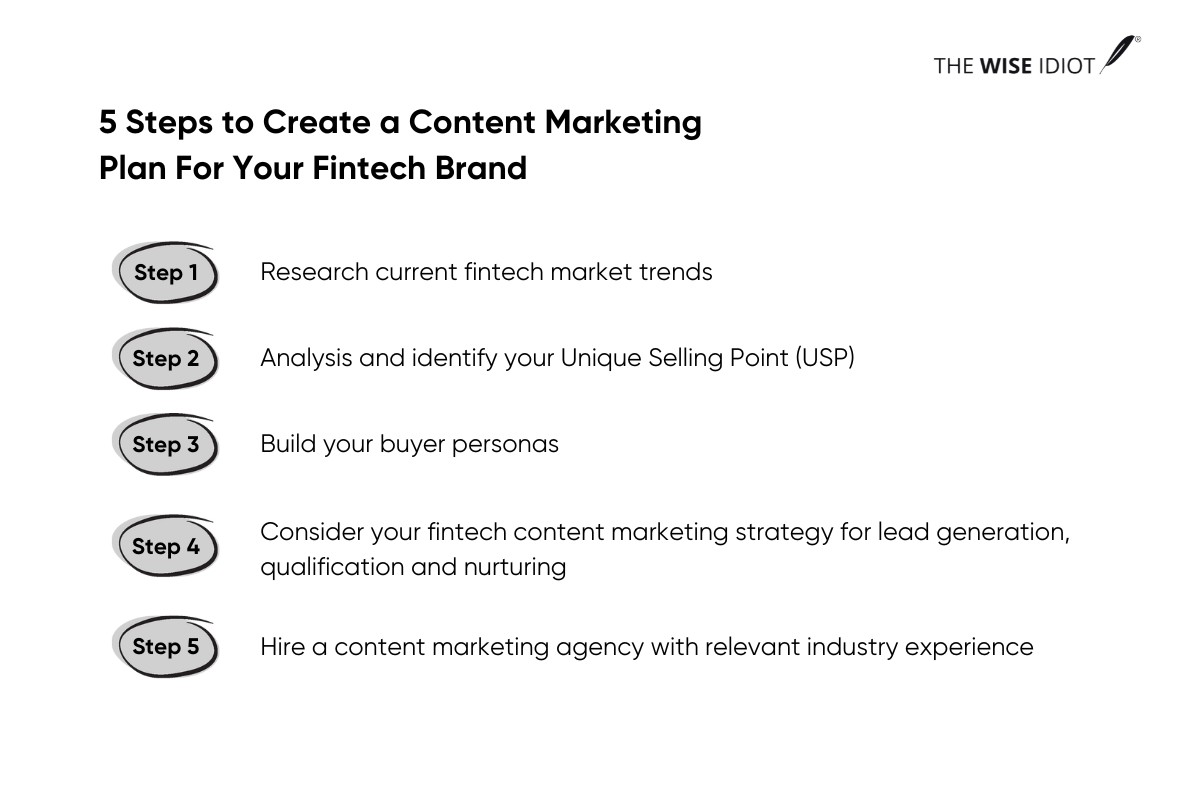

Toggle5 Steps to Create a Content Marketing Plan For Your Fintech Brand

Step 1: Research current fintech market trends

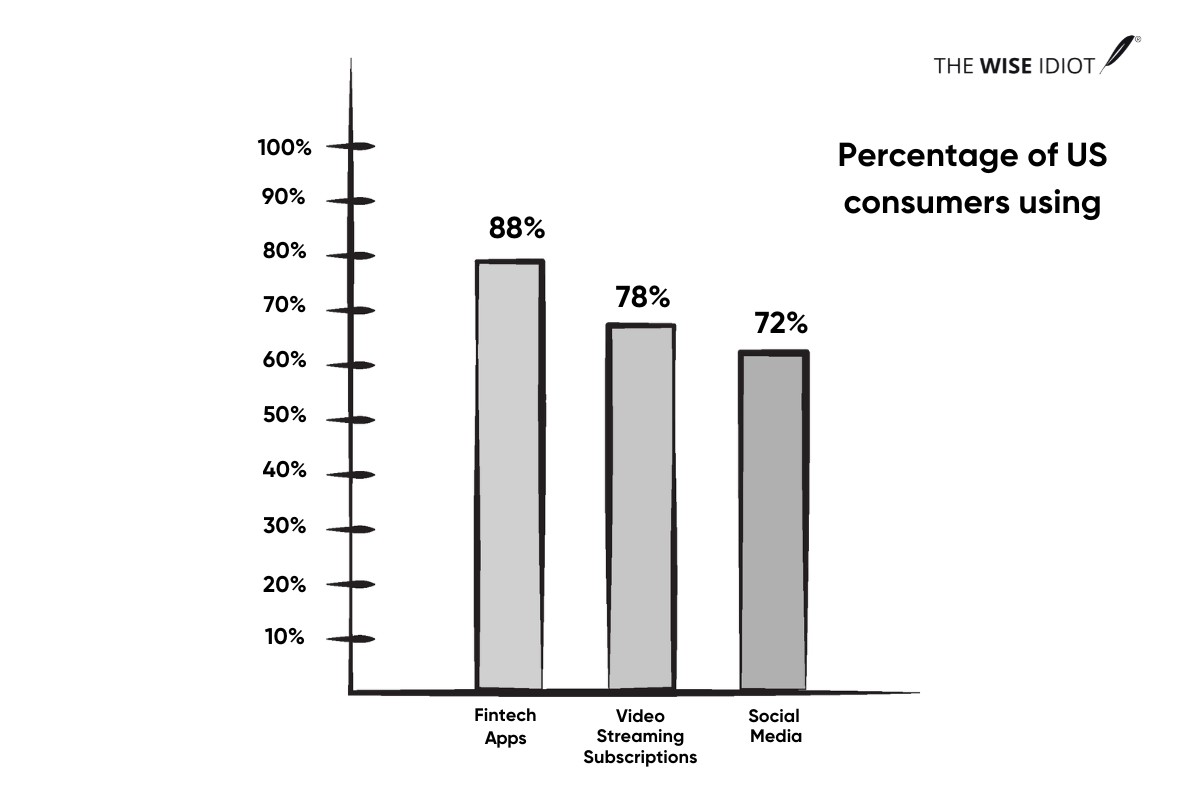

In today’s fast-paced world, the market constantly evolves, with new trends and technologies. As a fintech brand, keeping up with the latest market trends and insights is essential to stay ahead of the competition and cater to your audience.

Here are some effective ways to conduct market research in the fintech industry to get those ideas.

- Conducting market research surveys: Surveys are an excellent way to gather information directly from your target audience. You can use online survey tools to gather feedback on your product or service, understand customer preferences, and identify areas for content creation.

Fig: example of market research, Source: LeadSquared

- Analysing social media and online forums: Social media platforms and online forums are excellent sources of information about the fintech industry. You can gain insights into industry trends, consumer preferences, and competitor activities by monitoring conversations and discussions. For instance, some industry leaders have posted on social media about the challenges that your product can solve. It’s a good idea to create content that highlights how your brand can address those challenges. This will help showcase your product’s capabilities and provide solutions to potential customers.

- Analysing industry reports and publications: Industry reports and publications are a great source of information on current fintech trends and developments. You can use reports from reputable sources such as McKinsey, Deloitte, and KPMG and publications like FinTech Magazine and The Fintech Times to gain insights into the latest industry developments, emerging technologies, and consumer behaviour. Staying up-to-date with industry reports and publications can help you get ahead of the competition and provide relevant and latest content to your target audience.

- Attending fintech conferences and events: Conferences and events can be a great place to gather data for your content marketing strategy. For example, you can conduct surveys or interviews with attendees to gather insights and perspectives on various fintech topics.

- Networking with industry experts and thought leaders: Partnering with industry experts and thought leaders could bring new content ideas and perspectives, helping to keep your audience engaged. It can also boost your brand’s credibility and position you as a thought leader in fintech.

Step 2: Analysis and identify your Unique Selling Point (USP)

As a fintech company, it’s essential to have a solid content marketing strategy in place. However, before you dive into creating content, conducting a thorough analysis is important to ensure you’re setting yourself up for success. In this regard, two critical steps are conducting a SWOT analysis and identifying your Unique Selling Point (USP).

Let’s start with a SWOT analysis. This analysis helps you identify your company’s strengths, weaknesses, opportunities, and threats. These factors can help you better understand your company’s market position, competitors, and potential challenges.

For instance, you might identify that your company has a strong digital presence but lacks the resources to expand into new markets. Alternatively, you might find that your technology is superior to your competitors, but your marketing strategy is lacking. By understanding these factors, you can develop a targeted content marketing strategy that leverages your strengths and addresses your weaknesses.

The next step is to identify your USP. This unique value proposition sets your company apart from your competitors. It’s what makes your brand special and differentiates it from other players in the market.

Start by conducting a competitor analysis. Look at what your competitors are doing well and where they fall short. Then, look for opportunities to differentiate yourself. This could be through offering a more personalised service, using cutting-edge technology, or focusing on a particular niche within the market.

Once you’ve identified your USP, you can use it to develop a content marketing strategy that resonates with your target audience. For example, suppose your USP is providing personalised services. In that case, you might focus on creating content highlighting your customer service team and their commitment to providing a great experience for your clients. Alternatively, if your USP is cutting-edge technology, you might create content that showcases the latest developments in fintech and how your company is leading the way.

Step 3: Build your buyer personas

Once you have completed a comprehensive SWOT and competitor analysis, You need to construct a blueprint for your target audience to implement an effective content marketing strategy. Just as a blueprint helps architects and builders understand the needs and preferences of homeowners, a well-crafted buyer persona helps fintech companies understand the needs and preferences of their target audience.

Here are the steps that you can follow to build buyer personas for your fintech.

#1: Start by identifying the basic demographic information of your target audience, such as age, gender, income level, occupation, and location. This information helps you understand who your customers are and how you can tailor content to meet their needs.

#2: Utilise data analytics tools like Google Analytics, social media analytics, and CRM software to better understand your customers. These tools will help you gather important data on their behaviour, such as search, browsing, and purchase history. You can also collect customer feedback through surveys, reviews, and social media to learn about their preferences, pain points, and challenges.

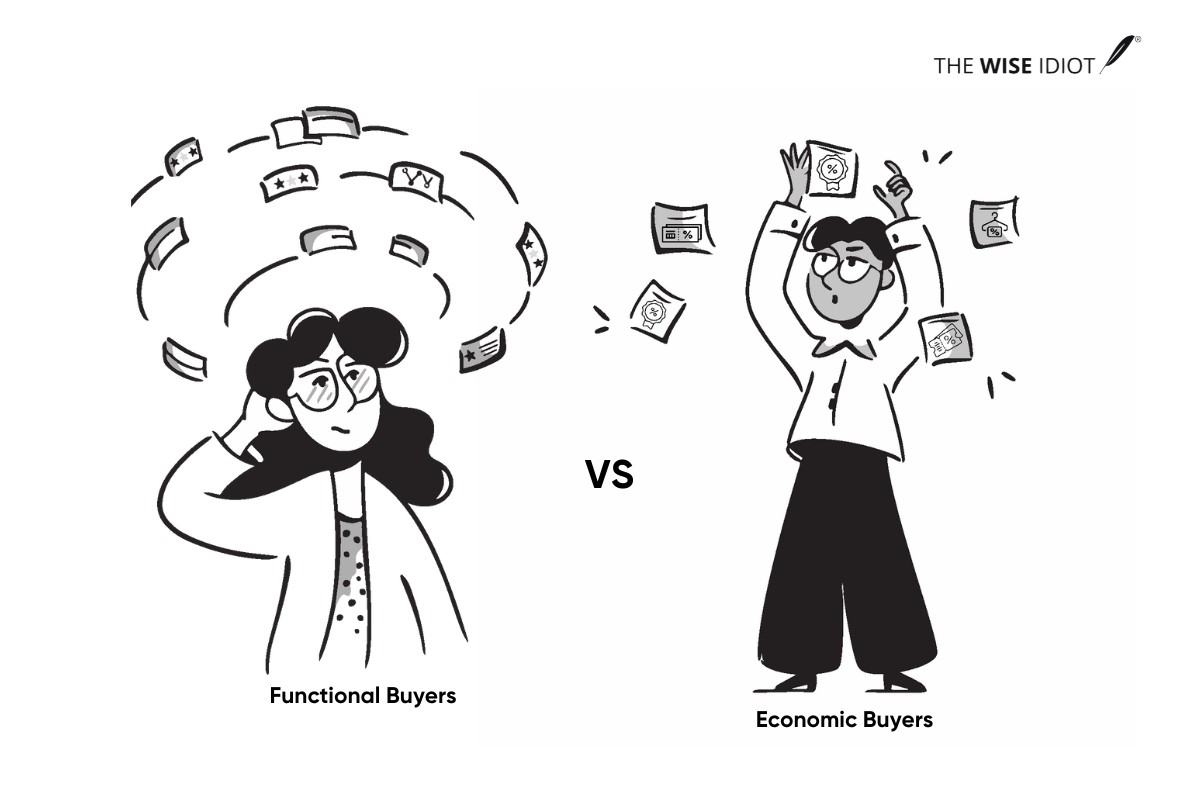

#3: Once you have gathered your customer data, segment those based on their needs and behaviour. Two common buyer types in fintech are Functional buyers and Economic buyers.

- Functional buyers are those who are primarily concerned with the functionality and features of your product or service. They are interested in how your product can help them solve specific problems, such as managing their day-to-day finance-related work.

- Economic buyers are primarily concerned with the cost-effectiveness of your product or service. They are interested in the value they can get for their money and could be more price-sensitive than functional buyers.

For example, a functional buyer of a treasury automation software company refers to a treasury analyst or treasury manager. In contrast, the economic buyer refers to higher-level positions such as Global Treasurer, CFO, or VP of Finance.

Step 4: Consider your fintech content marketing strategy for lead generation, qualification and nurturing

An effective fintech content marketing strategy can focus on quality lead generation to create a steady stream of new leads, grow the customer base, and increase revenue. Over time, content marketers establish relationships with leads and qualify them through the marketing funnel. Then, nurture those leads by providing valuable information and resources that address their needs and pain points.

Here are some tactics fintech content marketers (like The Wise Idiot ) follow for quality lead generation, qualification and nurturing.

Lead generation

- Creating high-quality blog posts: You can attract potential customers to your websites by creating insightful and informative blog posts. Build awareness of current industry challenges your target audience may face and offer solutions.

- Developing infographics: Infographics are a visually appealing way to present complex financial concepts and data in an easily digestible format. You can use infographics to educate potential customers and generate interest in your products or services.

- Offering free content: Fintech companies can offer potential customers free whitepapers, e-books, and other resources in exchange for their contact information. This can help build a database of leads that the company can later target with marketing campaigns.

Lead qualification

- Using interactive content: Interactive content such as quizzes and surveys can help fintech companies understand the needs and preferences of their potential customers. Companies can qualify leads that are most likely to be interested in their products or services.

- Analysing engagement metrics: By analysing engagement metrics such as click-through rates, time spent on the page, and bounce rates, content marketers can identify leads that are most engaged with their content. This can help fintech brands prioritise follow-up efforts and focus on leads that are most likely to convert.

Lead nurturing

- Creating personalised content: You can increase engagement and build stronger relationships with potential customers by creating personalised content that speaks directly to their needs and interests.

- Providing thought leadership content: With the help of content marketers, fintech companies can establish their expertise and earn the trust of potential customers by developing thought leadership content like whitepapers, research reports, and case studies. This kind of content can also educate leads and better prepare them for the sales process.

Step 5: Hire a content marketing agency with relevant industry experience

There are many hurdles on the road to successful fintech content marketing strategies. Dealing with an in-house content marketing team adds another layer to it. It can take time and money to hire skilled content creators, writers, editors, and marketers and to train them.

Generating in-depth, comprehensive, yet engaging content might be difficult for some fintech organisations. Here are some common challenges fintech brands often face.

- Technical jargon: The fintech industry is known for its technical language, which can be difficult for non-experts to understand. The in-house content marketing team often struggle to create content that is accessible to a wider audience while still conveying complex information accurately.

- Keeping up with trends: The fintech industry is constantly evolving, and new trends and technologies are always emerging. In-house, the content marketing team may not be familiar with these trends to create relevant and engaging content that resonates with their audience.

- Competing with established players: Fintech is a highly competitive industry. It can be challenging for in-house content marketing teams to distinguish themselves from established players and communicate their unique value proposition in a crowded market.

To address these challenges, a fintech content marketing agency like The Wise Idiot can assist you in the following ways.

- Simplifying technical language: Our team includes experts who can simplify technical jargon and communicate complex concepts in a way that is easy for non-experts to understand. We can create content that educates and engages your audience while still conveying the technical nuances of your product or service.

- Staying up-to-date with industry trends: We create content showcasing your brand’s expertise based on the latest trends and technologies in the fintech industry while keeping your audience informed and engaged.

- Differentiating your brand: The Wise Idiot can help you create a unique brand voice and messaging that sets you apart from established players in the industry. Our team develops a content marketing strategy highlighting the brand’s unique value proposition and resonating with TAM (Total Addressable Market).

What’s Next?

We understand that in the competitive world of fintech, it’s not enough to have a great product or service. You need to effectively communicate your unique value proposition and connect with your target audience through engaging and informative content. That’s where we come in.

At The Wise Idiot, we specialise in differentiated content marketing strategies for fintech brands! But don’t just take our word for it. Our track record speaks for itself.

Take your fintech brand to new heights with The Wise Idiot – Contact us today to schedule a consultation!

Frequently Asked Questions

Q1. I have a limited budget. How can I create effective content?

Ans: Focus on quality over quantity. Start by creating high-value blog posts or infographics that address your target audience’s financial pain points. Utilize social media platforms to promote your content organically and engage with your audience directly.

Q2. Fintech can be complex. How do I keep my content understandable?

Ans: Break down financial jargon! Explain technical terms in clear, concise language. Use visuals like infographics or short explainer videos to simplify complex concepts. Focus on storytelling and real-life examples to make your content relatable.

Q3. My target audience is broad (young professionals, families, retirees). How can I create content that appeals to everyone?

Ans: While you can’t target every financial need with every piece of content, you can create themes that resonate across generations. Focus on common financial goals like budgeting, saving for retirement, or building wealth. Tailor the content format and complexity of each segment. For young professionals, bite-sized infographics or short blogs might be ideal. For retirees, in-depth articles or eBooks on wealth preservation strategies could be more valuable.